Economic Valuation

Economic Evaluation Model’s Introduction

The valorization model of alluvial gold prospects allows to quantify the technical and economic variables of each project based on its main characteristics. The model was created considering the most common alluvial deposits, which is why it considers an open mine operation, as shown in the following flow diagram.

Based on the equipment, the value of each project was calculated considering the optimal capacities of each equipment using the geological variables of each prospect.

Once the projects were evaluated, they were grouped into three categories. The prospects with the highest potential and that were visited during field trips were grouped in deposits of interest’s category. On the other hand, the unseen prospects, or not found, but which economic variables turned out to be attractive, formed the category of potential deposits. Finally, projects with no economic value or without enough oz. troy of gold to be evaluated with this model were grouped as deposits of little interest.

The economic model attached to this website will be available under the name of "Alluvial Economic Model.xlsx"

Valuation Model’s Parameters and Assumptions

To evaluate the projects, the first thing needed was the geological variables. For this the model receives as an input mantle volume (m3), mantle Grades (mg / m3) and sterile ratio for the measured, indicated or inferred resources. Based on this information, the total mineralization gold potential of the project was calculated. With that information, its economic valuation was initiated.

After entering prospect’s geological variables, it was necessary to define the temporal variables for the evaluation, i.e. how many days a month to work, how many hours per day and how many shifts the operation would have to evaluate.

On the other hand, the operational parameters of each assessment had to be defined, i.e. the type of storage (hanging terraces, current terraces, paleochannel, beach placer) which changes the availability and use of equipment. On the other hand, the type of sedimentary column (boulders and clay, non-boulders and clay, boulders and non-clay, non-boulders and non-clay), which varied the availability and use of equipment, recovery and inclusion or not of trommell, just in case there is clay in the operation. Other parameters are the size and shape of gold particles (laminar coarse, sub-roughened coarse, intermediate laminar, sub-rounded intermediate, thin laminar and thin sub-rounded) and finally the size of the operation. This last variable not only determines plants capacity, but also defines parameters of people, equipment, among others. More details are given in section 3 of this report.

To generate the valuation model, the following economic parameters were considered:

The last parameters considered were the study ones, ie how many prefeasibility and feasibility studies would be made in the projects and how much value these studies would have. This parameter is defined based on the type of mining, the geological variables of each project and the information of previous studies that is available.

The number of equipment needed to operate was calculated based on the amount of material needed to move (mine) and process (plant). That’s why the number of operators is variable depending on the characteristics of each prospect. Loaders, trucks and excavator’s capabilities are determined by maximizing the NPV of the project. The possible capacities of these can be seen in the following table.

Types of Mining

As mentioned above, the following mining variable type or size of operation not only determines the plant capacity of the operation, it also establishes decisions within the model. From equipment’s capacity (plant) to the number of people who would work on the job.

To gather decisions five sizes of operations were created: Medium and Big Mining High Efficiency, Medium Mining High Efficiency, Medium Mining Low Efficiency, Small Mining High Efficiency and finally Small Mining Low Efficiency. Most of the times variables that are modified are the number of employees, their salary and the value of the plants equipment. The main characteristics of each size of operation will be defined below, for more details go to the report of the economic model available in Downloads.

The choice of the type of mining was based mainly on the economic variables of the evaluation the project had the highest NPV, IRR and IVAN and from that the size of the operation was defined. On the other hand, all the projects had to last at least 12 months and at most 20 years.

Medium Big Mining High Efficiency (MBMH)

The plant capacity of this category is 300 m3/h for all prospects, except for Lonquimay and Carelmapu. The last two used a plant capacity of 1,500 m3/h due to the large extent they have and were considered as special cases.

As for its technical variables, the parameters used for both the equipment located at the plant and equipment available at the mine can be seen in the following table, where "B", "NB", "C" and "NC" refer to the presence or absence of boulders, or presence or absence of clay, respectively.

Each type of mining has a different number of employees because the larger the size of the operation, the more people it takes to manage it and make it produce. The following figure shows an organization chart with the charges that are needed to operate a prospect of this size.

Medium Mining High Efficiency (MMH)

This operating size requires a 100 m3/h plant feed, the technical variables are like the ones in MBMH but somewhat lower in both availability and utilization, as shown in the following table. On the other hand, the organization chart of the company is the same as for the MBMH but the number of people in charge of certain areas decreases.

Medium Mining Low Efficiency (MML)

Like Medium High Efficiency Mining, this size of operation processes 100 m3/h and uses the same equipment, i.e. the investment and consumption of these will be the same as in the previous case. On the other hand, the availability, use and recovery decreases compared to the previous scenario, mainly due to operational deficiencies. In addition, the employees of this size of operation are organized in another way, the operation and management and financial managers disappear to leave the whole job depending on the general manager which will undoubtedly decrease efficiency.

Pequeña Minería de Alta Eficiencia (PMA)

Para operaciones de menores dimensiones, pero bien administradas y trabajadas se creó el tamaño de operación, Pequeña Minería de Alta Eficiencia. Este tipo de minería procesa en planta 25 m3/h, al ser de menor dimensión que los anteriores se requieren una menor cantidad de personas para administrar y trabajar.

As shown in the organizational chart, the disposition of people in this type of mining is quite different from the previous size of operation. In this case the organization is divided into three major areas, mine, plant and administration each depending on the general manager. Unlike the medium mining in this case disappear the managers of operations and finances so the operation is managed by dividing the work into three large groups. It is fundamental in this type of mining that the three areas work together and that the information be shared between the plant head, mine head and the management control engineers. As expected, the salaries for this size of operation are lower than in the case of medium-scale mining, mainly since with lower treatment capacity, revenues will decrease considerably

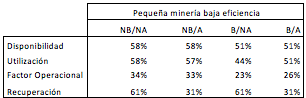

Small Mining Low Efficiency (SML)

As in the SML, the processing rate for this type of mining is 25 m3 / h. The main differences with the previous case is that the availability, use and recovery decrease. On the other hand, the organization of the company is quite different. In this case, the chief of mine must take charge of the whole operation, taking care of the treatment plant, the extraction of the ore and the administration of the work. For this reason, the technical parameters decrease.

Unlike the other sizes of operation, in this case centrifugal concentrators are not used to process the ore, but the use of gutters would be applied, which is why the recovery of the plant decreases.

Valuation Model Process

The operation of the evaluation model is simple, as explained above, mineralization gold potential and reserves, parameters and assumptions and salaries must be modified to make the evaluation effective. It is important to consider some models restrictions, which will be explained below.

The valuation model applies only to prospects containing over 7,000 oz. troy of gold. Otherwise the projects were not profitable because the investment was much higher than the profit that can be made using this type of mining.

The first thing to keep in mind is that the valuation model evaluates the projects considering a constant average Grades over time. With the information obtained in the reports during the bibliographic review stage, no more background of the Grades could be obtained. So, the projects must be evaluated considering this constant Grades. In mining, it is important to begin processing the deposits by sectors where the Grades is higher, to obtain better flows during the first years. Also, the Grades that are processed in the first periods are much higher than the average Grades of the deposit. So, evaluating the prospectus using a constant average Grades does not imply any significant change in the value of the project.

On the other hand, for the evaluation to be effective the duration of the project must be at least 12 months and up to 20 years. The start of the projects includes a ramp up of 3 months in the cases of the mining type SMH and SML. While for operations of the size MBMH, MMH and MML ramp up is 6 months. After the ramp up the rate of processing and movement is practically the same during all productions periods.

As for the costs, they change from period to period. For example, the cost of maintenance of equipment increases by 2% each year while using the same equipment. Investments in equipment (trucks, excavators, loaders) are done every 5 years, by that time the cost of maintenance is again the initial cost for each equipment.

The cycle times of each equipment are kept constant through the evaluation. That is why the production does not vary much from period to period. The revenues to be exploited are mainly those generated based on the amount of gold extracted while the main costs are mine cost, plant cost, G & A cost and investments.

Finally, the number of trucks, excavators, loaders and the size of the processing plant define how many operators and maintainers should be hired for whole operation.

Cash flow and Sensitivity Analysis

To calculate the value of the project, two cash flows were used, first a preliminary cash flow in which all the material is extracted until the mine is completely exhausted. In this case, it can happen that the revenues are lower than the operational costs, the project is losing value year by year. To remedy this possibility, a final cash flow was established which only evaluates the project until the income is greater than the operational costs, i.e. the operational flow is positive. Based on this scenario the net present value of the project was calculated, which was obtained by discounting the annual flows based on the discount rate, which was set at 15%.

Based on the final cash flow, the main variables were sensitized to show how robust the projects were, increasing and decreasing the value of the projects by 30%, considering intervals of 10%. The variables to be sensitized were:

-

Price

-

Grades

-

Recovery

-

Mine Cost

-

Plant Cost

-

Cost G & A

-

Investments

-

Volume

A spider diagram was used to plot the sensitivity analysis, Figure 5.1 shows an example of sensitivity for the Rio Pescado prospect.

As expected the impact of the NPV and IRR changing the price, Grades and recovery variables was the same, so it was included in the spider chart only one of these implying that the variation of the three is the same Impact for the project.